The Trump administration’s surprise announcement of a 50 percent tariff on copper imports has sent shockwaves through global commodity markets, reigniting fears of supply disruption, rocketing input costs, and retaliatory trade measures.

Copper futures on the Chicago Mercantile Exchange (COMEX) surged as much as 17 percent during yesterday’s session, the largest one-day gain in the history of the contract. Traders are now rushing to front-load shipments into the US ahead of the anticipated August 1 implementation date. Imposed under Section 232 of the Trade Expansion Act on national security grounds, the impost is expected to hit refined copper imports from major US trade partners, most notably Chile, Canada, and Mexico. The precise scope of the measure remains unclear, particularly whether it will cover scrap copper, semi-fabricated products, or exempt key allies.

Copper, an industrial metal, is among the most indispensable resources in the modern global economy. It is used in everything from household plumbing and automotive wiring to electric vehicle batteries, power grids, data centers, and wind turbines.

The demand for copper is so vast, and its market so liquid, that it is often dubbed “Doctor Copper” for its reliability as a leading indicator of economic health. Changes in copper prices ripple through the equity valuations of industrial firms, influence the exchange rates of resource-dependent countries like Chile (where copper makes up over 50 percent of total exports), and even affect the cost of electricity in regions where it is used heavily in infrastructure. In emerging markets, copper-linked revenues drive national employment and government budgets, amplifying the geopolitical stakes of policy whiplash. In 2024, the US consumed approximately 1.6 million tons of refined copper, while producing only about 850,000 tons domestically — highlighting America’s significant reliance on imports to meet industrial demand.

It’s likely that the tariff will lead to persistent regional price distortions, already visible in the unprecedented 25 percent premium of COMEX prices over those on the London Metal Exchange and Shanghai Futures Exchange. That wedge not only undermines market efficiency but also distorts physical supply chains. US net imports account for over a third of global demand. While domestic copper scrap could offer some marginal relief, sufficient smelting and refining capacity to scale processing will take years to develop. Jefferies analysts estimate it would take at least a decade to develop sufficient mining and smelting infrastructure for the US to reach self-sufficiency.

Once existing inventories are drawn down, domestic manufacturers are likely to face dramatically higher costs. This is particularly problematic for sectors like construction, renewable energy, and electric vehicles — ironically, areas the administration purports to support through other policy channels. Utilities, already capital-intensive businesses with high sensitivity to interest rates, will see their operating costs shift upward, which could delay projects or lead to downstream price increases for consumers. The breakneck pace of artificial intelligence innovation is likely to be hindered as well, with the cost of constructing data centers increasing substantially. Households or firms planning major electrical or plumbing projects may benefit from accelerating their timelines before rising input costs drive up estimates.

Chile and Mexico, both large copper exporters, initially saw their currencies strengthen on the news. The longer-term implications are more nuanced. Reduced volumes and lower margins could depress producer surpluses and result in job losses in mining-intensive regions.

China, the world’s largest copper consumer, is likely to gain competitively from the re-routing of global supply chains away from the US. Having significantly expanded its domestic smelting capacity over the last two decades, Beijing may be able to absorb diverted shipments at favorable prices, reinforcing its industrial base at a time of intensifying strategic competition with Washington, DC.

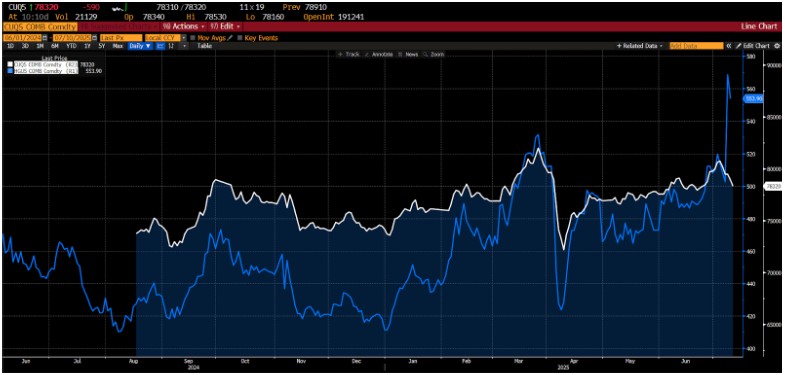

Image: US copper futures (COMEX, blue) & Chinese copper futures (Shanghai Futures Exchange, white), 12 months

COMEX copper prices spiked as traders rushed to lock in supply before the tariff took effect, anticipating sharply higher domestic prices. Meanwhile, copper futures prices in Shanghai declined, with copper originally destined for the US redirected into global markets. Chinese industrial enterprises are now able to buy more copper at lower prices.

Tariffs of this magnitude on a non-substitutable, industrially critical input like copper are, in a word, reckless. By imposing a blanket 50 percent duty without a clear timeline, scope, or even carve-outs for allied nations, the administration risks weakening US competitiveness, bolstering competitors, and damaging long-standing trade relationships.

Beyond that, the move undermines Trump’s own stated objectives: reviving US manufacturing and countering Chinese influence. Driving up domestic prices, shifting investment overseas, and handing other nations — the BRICS+ bloc, in particular — a golden opportunity to ramp up their dominance in global manufacturing. Copper wires the world, and voluntarily severing the US from global copper markets is a costly and self-defeating proposition.